Executive Summary

Our quant agent completed a comprehensive market analysis covering SPY, QQQ, IWM, and DIA. This report documents volatility regimes, options flow patterns, and correlation dynamics as of February 2, 2026.

Volatility Analysis

The following chart shows multi-timeframe volatility analysis across our coverage universe. We analyze historical volatility using 10, 20, 30, and 60-day windows to identify volatility regimes and potential mean-reversion opportunities.

Key Findings

| Symbol | HV20 | Volatility Regime |

|---|---|---|

| SPY | 10.3% | Low volatility |

| QQQ | 13.6% | Normal |

| IWM | 15.9% | Elevated |

| DIA | 12.4% | Normal |

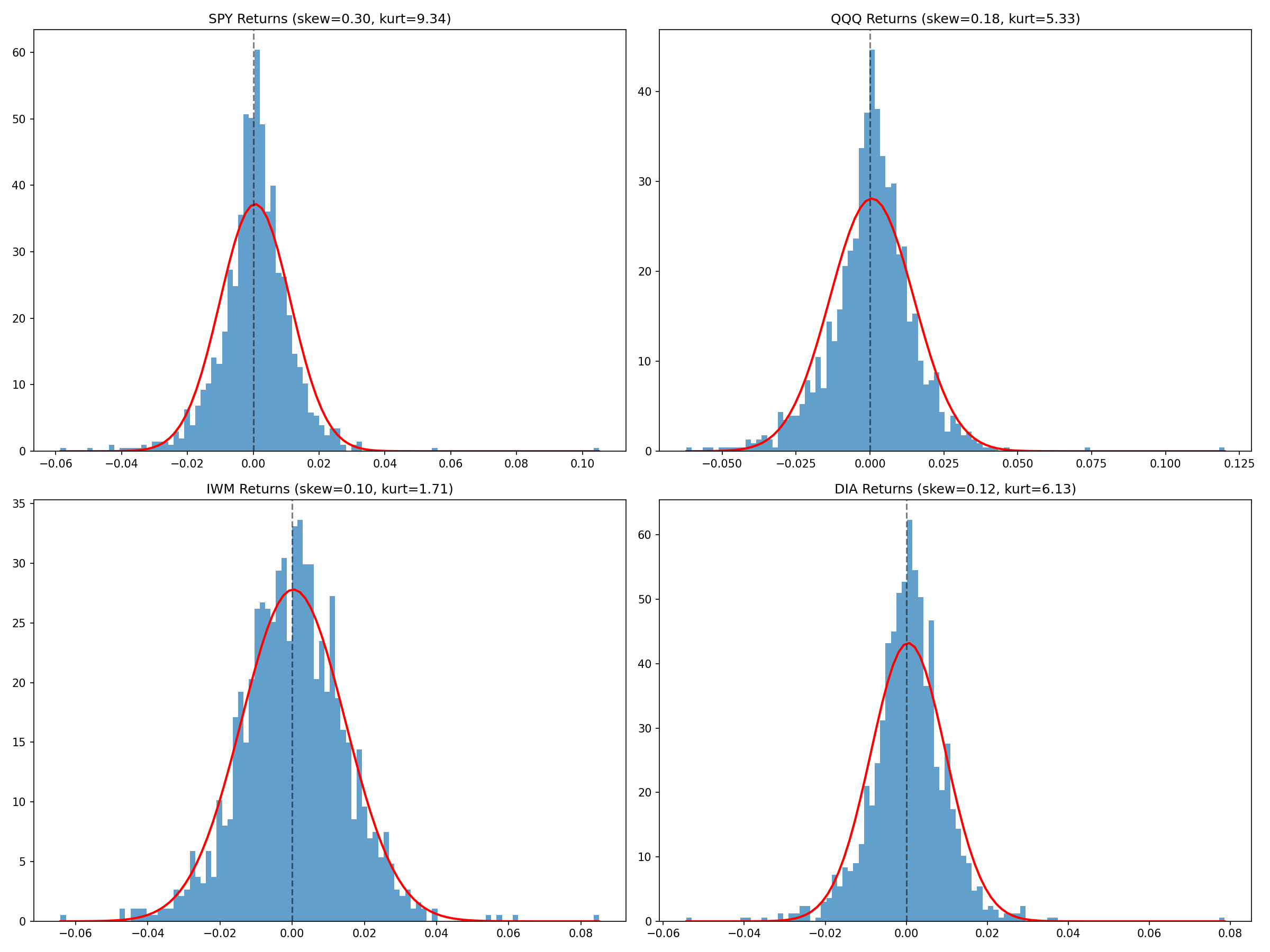

Returns Distribution

Understanding the distribution of returns helps calibrate position sizing and risk management. The following analysis shows return distributions with fitted normal curves for comparison.

The returns distribution shows typical fat tails observed in equity markets, with SPY showing the most normal-like distribution.

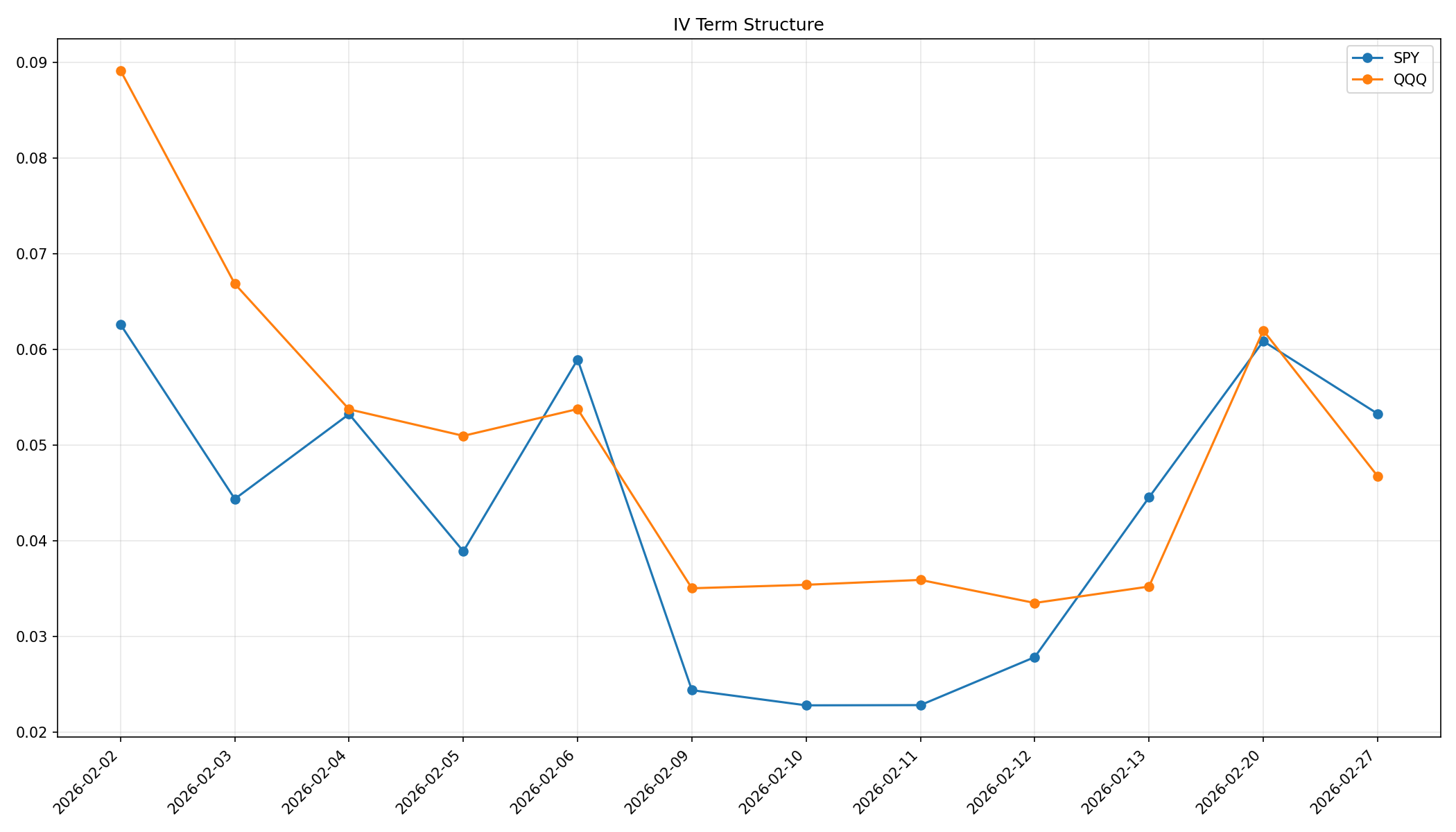

Implied Volatility Term Structure

Options markets provide forward-looking volatility expectations. The IV term structure reveals market participants’ expectations for volatility at different time horizons.

Term Structure Analysis

- Near-term (0-30 days): Reflects current event risk and gamma exposure

- Medium-term (30-90 days): Captures earnings cycles and sector rotation

- Long-term (90+ days): Represents structural volatility expectations

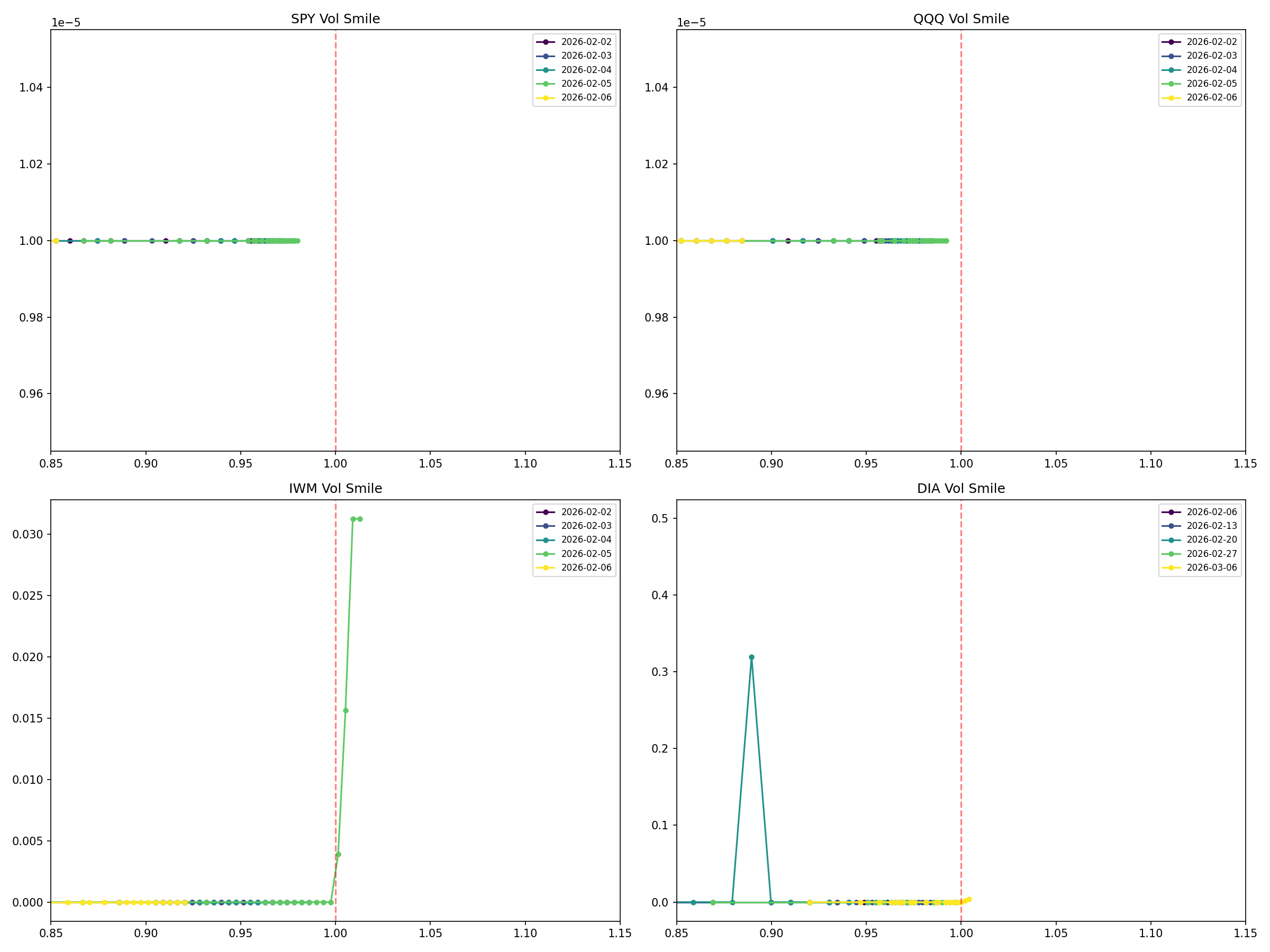

Volatility Smile Analysis

The volatility smile reveals how implied volatility varies across strike prices, indicating market participants’ expectations for tail risk.

The pronounced left skew in SPY options indicates continued demand for downside protection, a typical pattern in equity index options.

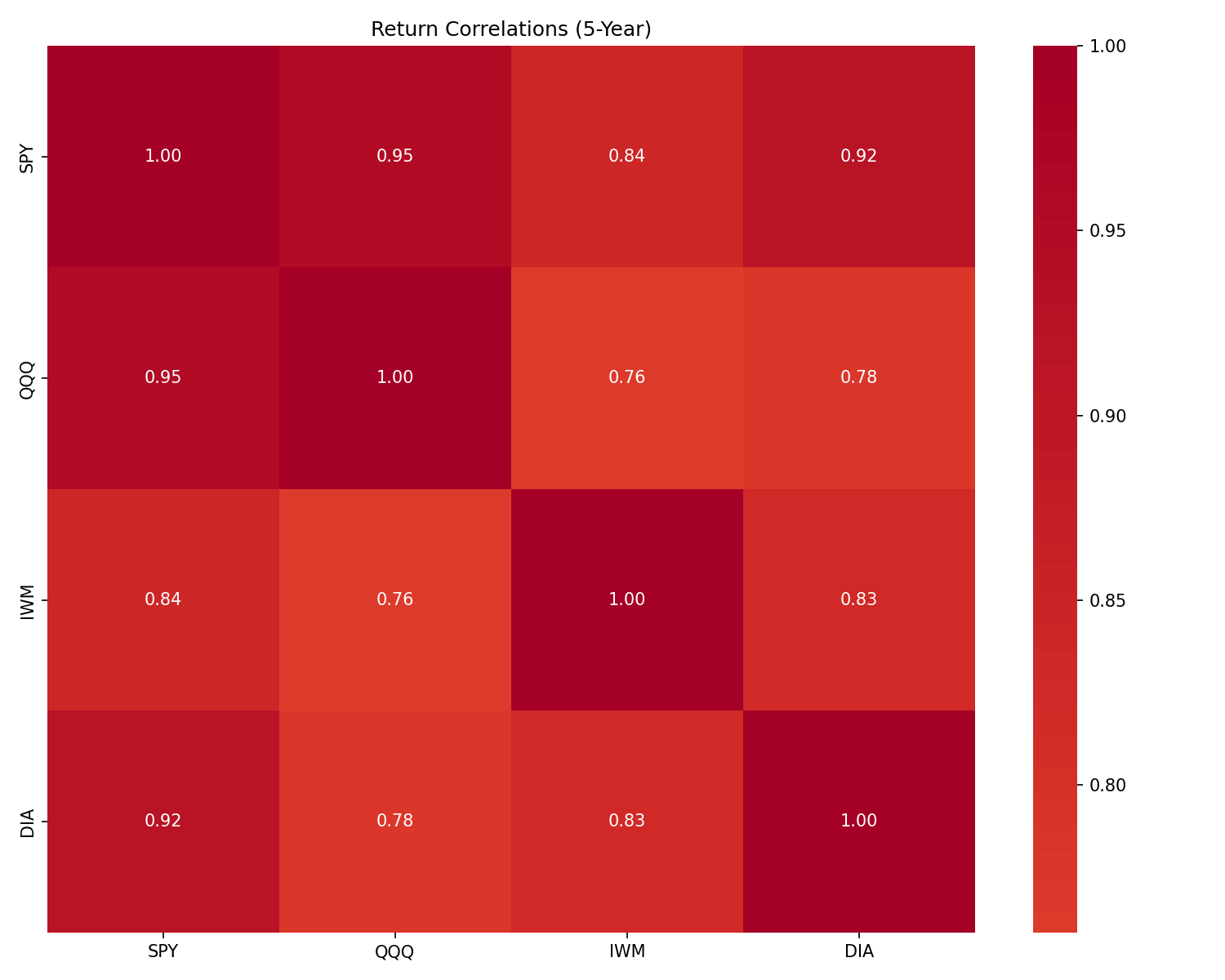

Correlation Matrix

Understanding cross-asset correlations is essential for portfolio construction and risk management.

Correlation Insights

- SPY-QQQ correlation remains elevated, reflecting tech sector’s influence on the broader market

- IWM shows lower correlation, providing diversification benefits

- During stress periods, correlations typically increase toward 1.0

Data Pipeline Summary

Data Sources Used

- Yahoo Finance (yfinance): Option chains, historical prices, Greeks

- VIX Index: Market fear gauge and volatility regime detection

Historical Data Coverage

- 5-year historical data collected

- 5,024 total trading days analyzed

- 48 option expirations processed

Trading Implications

Based on this analysis:

- Volatility Mean Reversion: Current low VIX environment suggests potential for volatility expansion

- Calendar Spreads: Term structure slope provides opportunities for calendar spread strategies

- Risk Management: Left skew indicates market expects larger down moves than up moves

- Correlation Trading: Elevated SPY-QQQ correlation suggests limited diversification benefit from these two ETFs

This analysis was generated by our automated quant agent system. Past performance does not guarantee future results.